What is Solar Funding Incentive?

Listed below are the 4 different types of solar Funding incentive available.

- Feed-in Tariff (FIT)

- Smart Export Guarantee (SEG)

- Reduced VAT on Energy Products

- Renewable Heating

The Feed In Tariff (FIT)

Firstly the Feed-In Tariff is a solar funding incentive that started back in 2010 ran with success for many years and was a great solar incentive. Unfortunately, this scheme has now been scrapped. Meaning that you can no longer claim unless you signed up before March 2019.

If you were signed up before March 2019 under this scheme. You could not only save money on your electricity bills. But you could also profit by selling electricity produced by your solar panels back to your supplier.

Under this scheme, you were guaranteed payments for 20 years. Significantly reducing payback times for your initial outlay on the installation.

Reduced VAT

If you are in receipt of a state pension, universal credit or disability benefits. You could be entitled to a 5% tax reduction on energy-saving products such as solar panels.

You would have to meet a specific criteria type, and the reduction may apply to the whole product or just the installation, depending on criteria demands met.

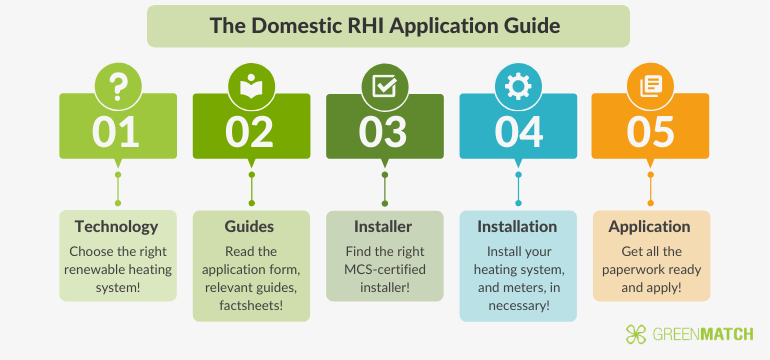

Renewable Solar Heating Incentive (RHI)

The domestic RHI is a Government-backed scheme. It aims to give private households and businesses incentive to install where possible renewable heating solutions. Including ground source heat pumps and solar thermal heating.

The government provide financial incentives to install these products on their premises and make payments determined on the amount of energy produced by these systems.

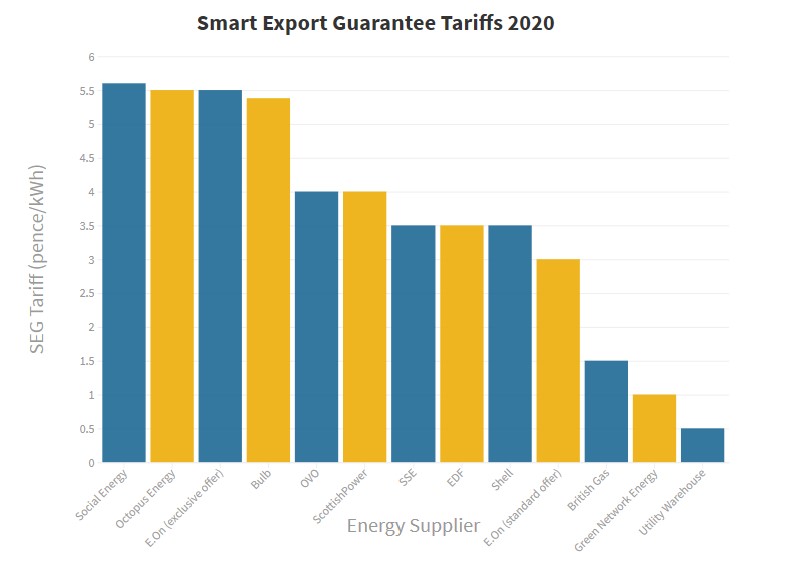

Smart Export Guarantee (SEG)

The Smart Export Guarantee pays households for renewable energy generated by solar panels. It replaces the Feed-In Tariff mentioned previously.

The larger energy companies have an obligation to offer the SEG scheme. Any company with more than 150000 customers must offer this scheme, and smaller companies can voluntarily opt.

The SEG scheme pays customers for any energy generated but not used by the household offering an incentive by lowering energy bills further.

Any homeowner with solar panels can claim this incentive with solar systems up to 5mw capacity. The household must have a smart meter to track energy use and calculate payments accordingly.

This incentive makes solar panels the perfect home improvement to optimize energy use and save on energy bills.

How to apply for solar funding incentives?

You can find further information by clicking on the link here. Check your eligibility for funding by entering your postcode and answering a few simple questions.

Each solar panel funding incentive has its unique criteria demands, so to make it simple, use our form to check what funding you could be entitled to today and start saving on your energy bills.